However, the Divvy card is still relatively new – the company was only founded in 2016 – and it looks like Divvy still has some transparency issues to work out.īefore you sign up for Divvy, it’s worth connecting with a representative to learn exactly how it can help your business grow and to answer any outstanding questions about eligibility, fees or any other aspect of the Divvy card that remains unclear. If you are a small business owner considering a corporate credit card, it might be worth adding the Divvy credit card to your shortlist. Here’s how it stacks up against two other popular options:Īt least $50,000 in business bank account ($100,000 if personally invested) Instead, we need to compare the Divvy Card to other business credit cards designed to be used by startups and corporations. Since the Divvy card is a corporate credit card, we can’t evaluate it against credit cards designed for sole proprietors and small business owners like the Ink Business Unlimited® Credit Card offered by Chase or even The Business Platinum Card® from American Express. How does the Divvy credit card compare to the best business credit cards? Comparing Divvy card to other small business credit cards When you sign up with the Divvy card, you can earn different levels of rewards based on the frequency with which you pay off your balance: CategoryĪs you can see, shorter payment cycles yield higher rewards – and these rewards can be redeemed for Divvy Travel, statement credits, gift cards or cash back. Use your Divvy Capital funding to manage cash flow or cover unexpected expenses. Divvy CapitalĬonsidering a small business loan? Divvy Capital streamlines the lending process by providing instant cash to qualified Divvy customers. Business owners can reward employees for choosing more cost-effective hotel options, for example, and the Divvy Travel system keeps track of each traveler’s preferences in order to streamline future bookings. Divvy Travelĭivvy has partnered with TripActions to create a comprehensive travel and expense management experience. Employees can also use the Divvy mobile app to select budgets and request additional funds.

Divvy log in software#

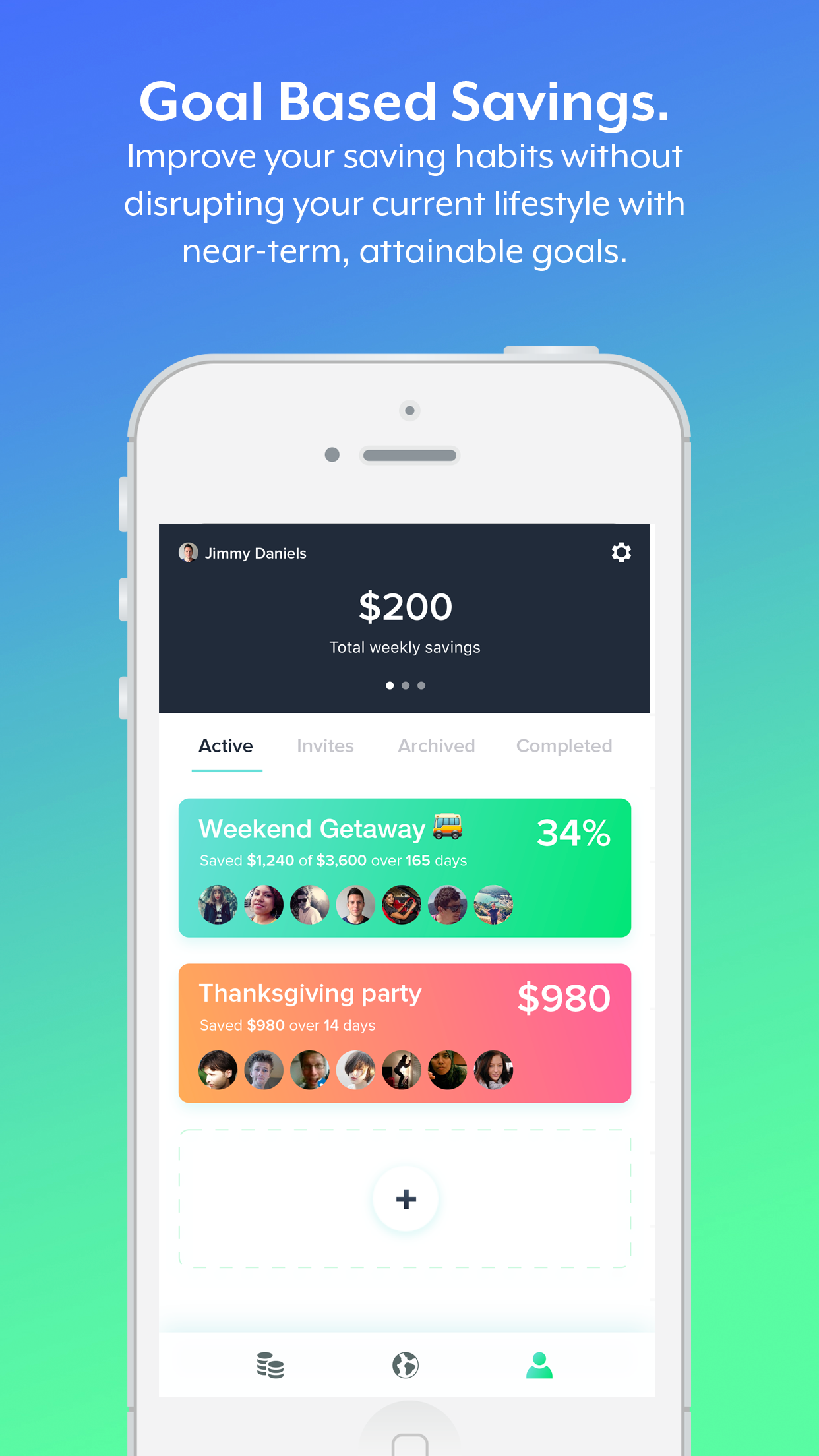

Divvy smart cardsĭivvy’s smart card system works with the Divvy card app and external software integrations to provide a current, accurate picture of your company’s spending, with the ability to update, allocate or limit your budget in real-time. You can use the app to create, track and freeze individual virtual cards as necessary. This not only keeps your Divvy credit card number secure, but also helps you set per-month spending limits on each virtual card. The Divvy virtual card feature lets you create a unique virtual card for each vendor. Here are five ways that your company could benefit from using Divvy. The Divvy credit card offers a number of benefits and features, from software integrations to a unique travel expense platform. Both Trustpilot and Merchant Maverick gave Divvy three out of five stars, with reviewers calling out Divvy’s lack of transparency and questionable sales tactics as potential issues – and the Better Business Bureau only awarded Divvy a B+ rating. Unfortunately, reviews of the card are mixed. Who uses Divvy? Software companies and nonprofits such as Noom and Habitat for Humanity have incorporated Divvy into their businesses.

Plus, Divvy helps your business earn rewards on every purchase, and these rewards can be redeemed for statement credits, travel, gift cards or cash back.

You can create unique virtual Divvy cards for each vendor your company works with, use Divvy’s limit spend feature to prevent your team from going over budget and let the QuickBooks online integration automatically transfer Divvy card transactions into your accounting software. It helps small business owners set, track and adjust budgets on the fly – while simultaneously eliminating the need for expense reports. The Divvy card is a smart credit card that is designed to maximize small business flexibility. Let’s take a close look at how the Divvy card works – and whether you should consider it for your business. Unlike personal credit cards and small business credit cards, the Divvy card is only available to certain types of corporations, startups and nonprofits – but the actual eligibility requirements for a Divvy card are unclear. Divvy hasn’t been around for very long, and there are some potential concerns about its transparency. That said, there are also some potential drawbacks to the Divvy card. Designed as a tool to help businesses manage expenses, adjust budgets, limit spending and access capital, the Divvy card offers a number of benefits, features and rewards that could help your business reach the next level. The Divvy card is a relatively new entry into the smart business credit card market.

0 kommentar(er)

0 kommentar(er)